Jobs That May Not Require a Social Security Number: A Comprehensive Guide

Related Articles: Jobs That May Not Require a Social Security Number: A Comprehensive Guide

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Jobs That May Not Require a Social Security Number: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Jobs That May Not Require a Social Security Number: A Comprehensive Guide

The Social Security number, a nine-digit identifier issued by the Social Security Administration (SSA), is a cornerstone of the American economic and social fabric. It serves as a crucial tool for tracking income, taxes, and benefits, facilitating a wide range of financial transactions and government services. However, certain employment opportunities exist where the requirement for a Social Security number may be waived or modified, offering alternative pathways for individuals who may not possess or choose not to disclose this identifier.

Understanding the Rationale for Exemptions:

The absence of a Social Security number can stem from various circumstances. Some individuals may be undocumented immigrants, others may have religious objections to the use of such identifiers, and some may simply prefer to maintain a degree of privacy. Regardless of the reason, certain jobs can accommodate these situations, enabling individuals to participate in the workforce without disclosing their Social Security number.

Key Categories of Jobs:

While the range of jobs that may not require a Social Security number is relatively limited, specific sectors and positions stand out. These include:

-

Cash-Based, Short-Term, or Temporary Jobs: These positions often involve direct payment for services rendered, with minimal administrative requirements. Examples include:

- Day Labor: Construction, landscaping, and other manual labor jobs where payment is typically received on a daily or weekly basis.

- Gig Economy Work: Freelancing, ride-sharing, and delivery services where independent contractors are often paid directly through platforms without extensive background checks.

- Seasonal Work: Agricultural, hospitality, and retail positions with temporary employment contracts, often with less stringent documentation requirements.

- Small, Unincorporated Businesses: Small businesses, particularly those operating in cash-based industries, may have less stringent documentation requirements, potentially allowing for employment without a Social Security number.

- Certain Non-Profit Organizations: Non-profit organizations, particularly those focused on serving marginalized communities, may have policies that allow for employment without a Social Security number, especially for positions that do not involve government funding or reporting.

- Domestic Work: House cleaning, childcare, and other domestic services often involve direct payment and less formal employment arrangements, potentially allowing for employment without a Social Security number.

Crucial Considerations and Legal Compliance:

While the possibility of finding jobs without a Social Security number exists, it is crucial to understand the legal and practical implications:

- Tax Obligations: Even without a Social Security number, individuals are still responsible for paying taxes on their income.

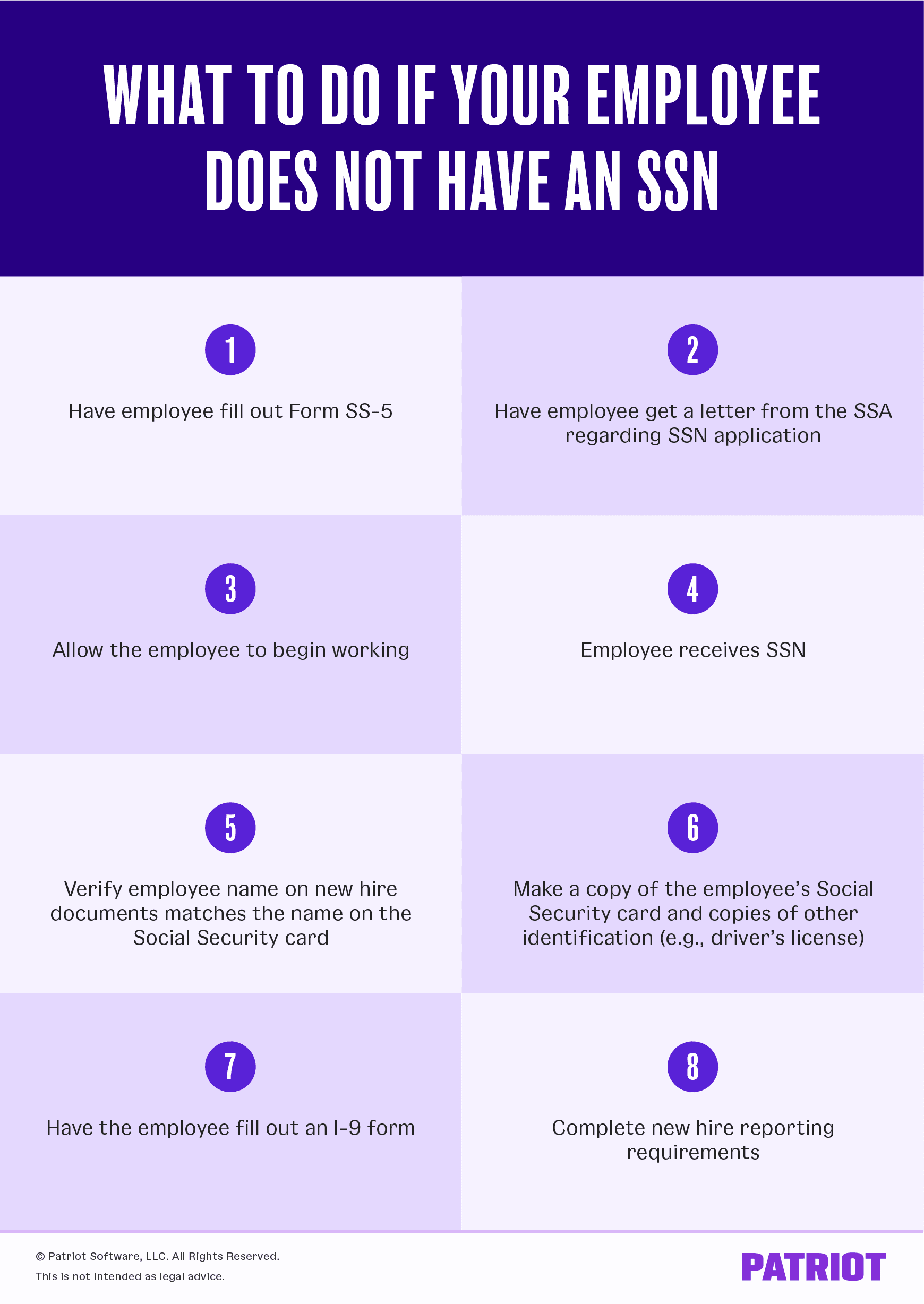

- Employment Verification: Employers may require alternative forms of identification, such as a driver’s license or passport, for employment verification and background checks.

- Benefits Eligibility: Individuals without a Social Security number may be ineligible for certain government benefits, such as unemployment insurance, Social Security retirement benefits, and Medicare.

- Labor Laws and Regulations: All employment, regardless of the presence or absence of a Social Security number, must comply with federal and state labor laws, including minimum wage, overtime pay, and workplace safety regulations.

FAQs Regarding Jobs Without Social Security Numbers:

Q: Can I work in the United States without a Social Security number?

A: While some jobs may not explicitly require a Social Security number, it is generally illegal to work in the United States without authorization, including a valid work permit or visa.

Q: Is it legal for an employer to hire me without a Social Security number?

A: The legality of hiring individuals without a Social Security number depends on the specific circumstances and applicable laws. While some jobs may be exempt from certain requirements, employers are still obligated to comply with all federal and state labor laws.

Q: What are the risks of working without a Social Security number?

A: Working without a Social Security number can expose individuals to various risks, including:

- Exploitation: Employers may take advantage of individuals without a Social Security number by offering lower wages, poor working conditions, or delaying payments.

- Tax Penalties: Individuals may face fines and penalties for failing to pay taxes on their income.

- Immigration Issues: Undocumented immigrants working without authorization may face deportation.

Q: What are the alternatives to a Social Security number for employment?

A: In some cases, employers may accept alternative forms of identification, such as a driver’s license or passport. However, these documents may not be sufficient for all purposes, and employers may still require a Social Security number for tax reporting or other legal obligations.

Tips for Finding Jobs Without a Social Security Number:

- Network: Connect with individuals in your community who may have knowledge of job opportunities that do not require a Social Security number.

- Consult with Legal and Immigration Professionals: Seek guidance from legal professionals regarding your specific situation and potential employment options.

- Explore Cash-Based Industries: Consider jobs in industries that often involve direct payment for services rendered, such as day labor, gig work, or domestic services.

- Focus on Small Businesses: Small, unincorporated businesses may have less stringent documentation requirements.

- Be Transparent with Potential Employers: Be upfront about your situation and inquire about the employer’s policies regarding employment without a Social Security number.

Conclusion:

While finding employment without a Social Security number may be possible in certain situations, it is crucial to approach these opportunities with caution and awareness. Individuals should thoroughly understand the legal and practical implications, ensuring compliance with all labor laws and tax obligations. It is essential to consult with legal and immigration professionals to navigate the complexities of employment without a Social Security number and to protect your rights and interests.

Closure

Thus, we hope this article has provided valuable insights into Jobs That May Not Require a Social Security Number: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!