Navigating Employment in the USA Without a Social Security Number

Related Articles: Navigating Employment in the USA Without a Social Security Number

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Employment in the USA Without a Social Security Number. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Employment in the USA Without a Social Security Number

The Social Security Number (SSN) serves as a vital identifier in the United States, facilitating a wide range of essential services, including employment, taxation, and credit. However, certain individuals may find themselves in situations where obtaining an SSN proves challenging or impossible. This article delves into the complexities of finding employment in the USA without a Social Security Number, exploring the limitations, potential avenues, and considerations involved.

Understanding the Challenges:

The absence of an SSN significantly restricts employment opportunities in the United States. Most employers require an SSN for tax reporting, background checks, and verifying employment eligibility. This requirement stems from the Immigration Reform and Control Act of 1986, which mandates employers to verify the legal status of their employees through the I-9 form.

Limited Options:

While obtaining employment without an SSN is challenging, it is not entirely impossible. Certain sectors and industries offer opportunities for individuals without an SSN, though these are often limited and may come with specific caveats:

- Cash-based Businesses: Some small businesses, particularly in the service industry, may be willing to employ individuals without an SSN, often paying in cash. However, this approach presents significant risks, as it lacks legal protection for both the worker and the employer.

- Temporary Employment Agencies: These agencies may offer short-term assignments, particularly in industries like manufacturing, construction, or agriculture, where the need for temporary labor is high. However, these positions often lack benefits and may involve inconsistent work schedules.

- Independent Contractor Work: Individuals can pursue self-employment opportunities as independent contractors, offering services in areas like writing, graphic design, or consulting. This allows for flexibility but necessitates self-management and responsibility for taxes and benefits.

- Non-Profit Organizations: Certain non-profit organizations, particularly those serving immigrant communities, may offer employment opportunities for individuals without an SSN. These positions often focus on social services, education, or advocacy.

Alternative Identification Documents:

While an SSN is generally required, certain alternative documents can be used for employment verification. These documents vary depending on the individual’s circumstances and may include:

- Individual Taxpayer Identification Number (ITIN): The IRS issues ITINs to individuals who are required to file US taxes but are ineligible for an SSN. ITINs can be used for employment purposes, but they may not be accepted by all employers.

- Consular ID Cards: Foreign nationals who are legally residing in the US may use consular ID cards for employment verification, depending on the employer’s policies.

- Passport: A valid passport can be used as a form of identification, but it may not be sufficient for employment verification in all cases.

Seeking Legal Counsel:

Navigating the complexities of employment without an SSN can be overwhelming. Seeking legal counsel from an immigration attorney is highly recommended. An attorney can provide accurate information about legal options, explain applicable laws, and advocate for the individual’s rights.

Frequently Asked Questions (FAQs):

Q: Can I work in the US without a Social Security Number?

A: It is extremely difficult to find legal employment in the US without a Social Security Number. However, certain limited opportunities may exist, particularly in cash-based businesses or temporary employment agencies.

Q: What are the risks of working without a Social Security Number?

A: Working without an SSN can expose individuals to significant risks, including:

- Exploitation by unscrupulous employers: Lack of legal protection can lead to wage theft, unsafe working conditions, and unfair treatment.

- Tax penalties: Individuals may face fines and penalties for not paying taxes on their earnings.

- Immigration consequences: Working without proper authorization can jeopardize future immigration status.

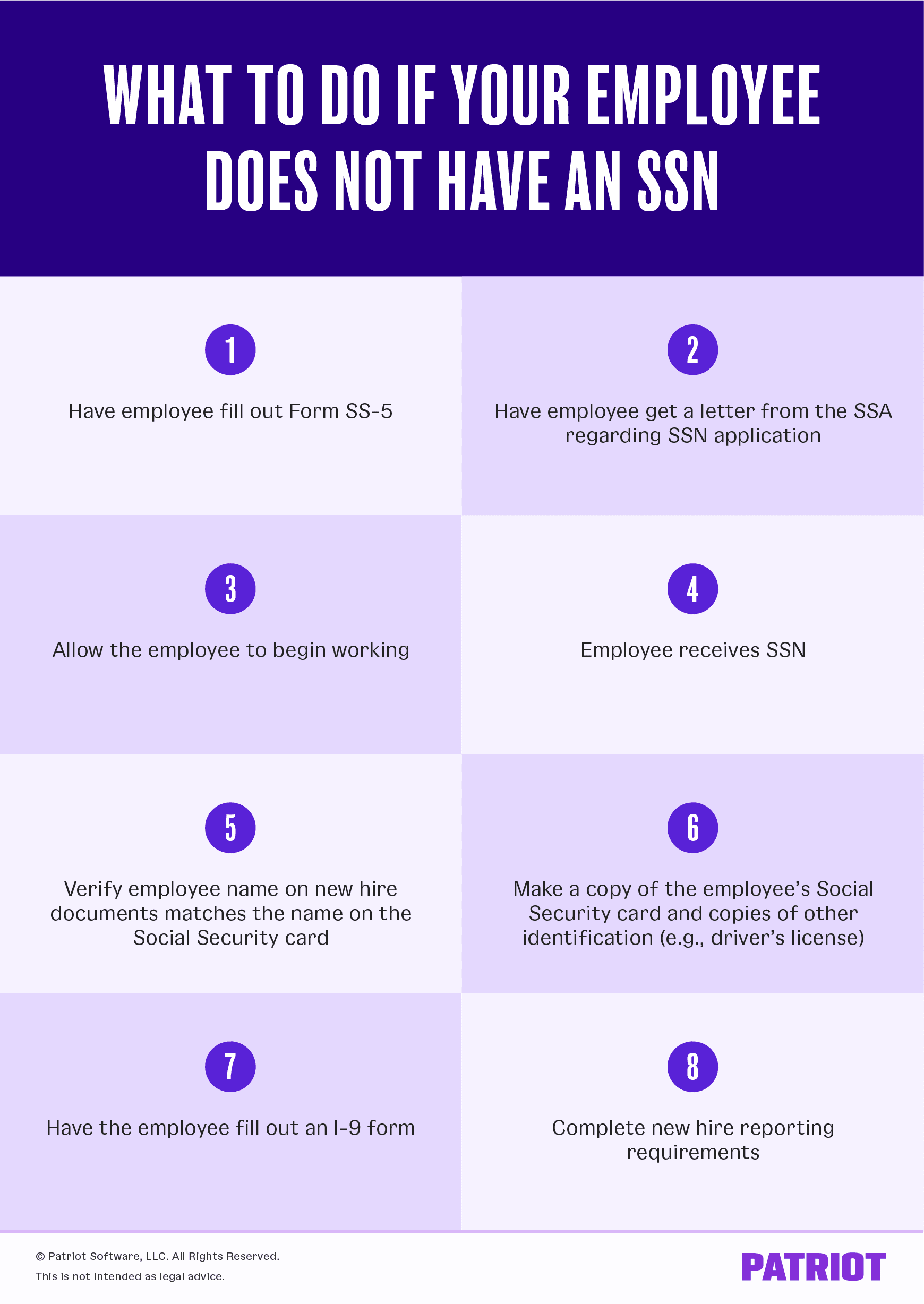

Q: How can I obtain a Social Security Number?

A: The process of obtaining an SSN varies depending on the individual’s circumstances. Generally, individuals must provide documentation proving their identity, legal residency status, and eligibility for an SSN.

Q: What are the benefits of having a Social Security Number?

A: Obtaining an SSN provides numerous benefits, including:

- Access to legal employment: It enables individuals to work legally and receive benefits like unemployment insurance and workers’ compensation.

- Tax filing: It allows individuals to file taxes and claim deductions and credits.

- Access to credit: It enables individuals to build credit history and obtain loans and credit cards.

Tips for Seeking Employment Without a Social Security Number:

- Research thoroughly: Explore industries and organizations that may be more open to employing individuals without an SSN.

- Network: Connect with individuals who have experience working without an SSN to gather insights and potential leads.

- Be transparent: Inform potential employers about your situation and the documents you can provide.

- Seek legal advice: Consult with an immigration attorney to understand your legal options and rights.

- Consider alternative employment paths: Explore opportunities like self-employment or freelancing that may not require an SSN.

Conclusion:

Finding employment in the USA without a Social Security Number presents significant challenges and risks. However, individuals facing this situation should explore all available options, seek legal guidance, and remain persistent in their job search. While the path may be difficult, understanding the limitations, legal requirements, and available resources can increase the chances of finding suitable employment. Remember, pursuing legal and ethical employment practices is crucial for ensuring both personal well-being and a positive contribution to the workforce.

Closure

Thus, we hope this article has provided valuable insights into Navigating Employment in the USA Without a Social Security Number. We thank you for taking the time to read this article. See you in our next article!